South America Bike Sharing Market Global Size, Industry Trends, Revenue, Future Scope and Outlook 2032

South America Bike Sharing Market to Reach USD 150.83 Million by 2032, Driven by Urban Mobility Demand and Sustainable Transport Initiatives

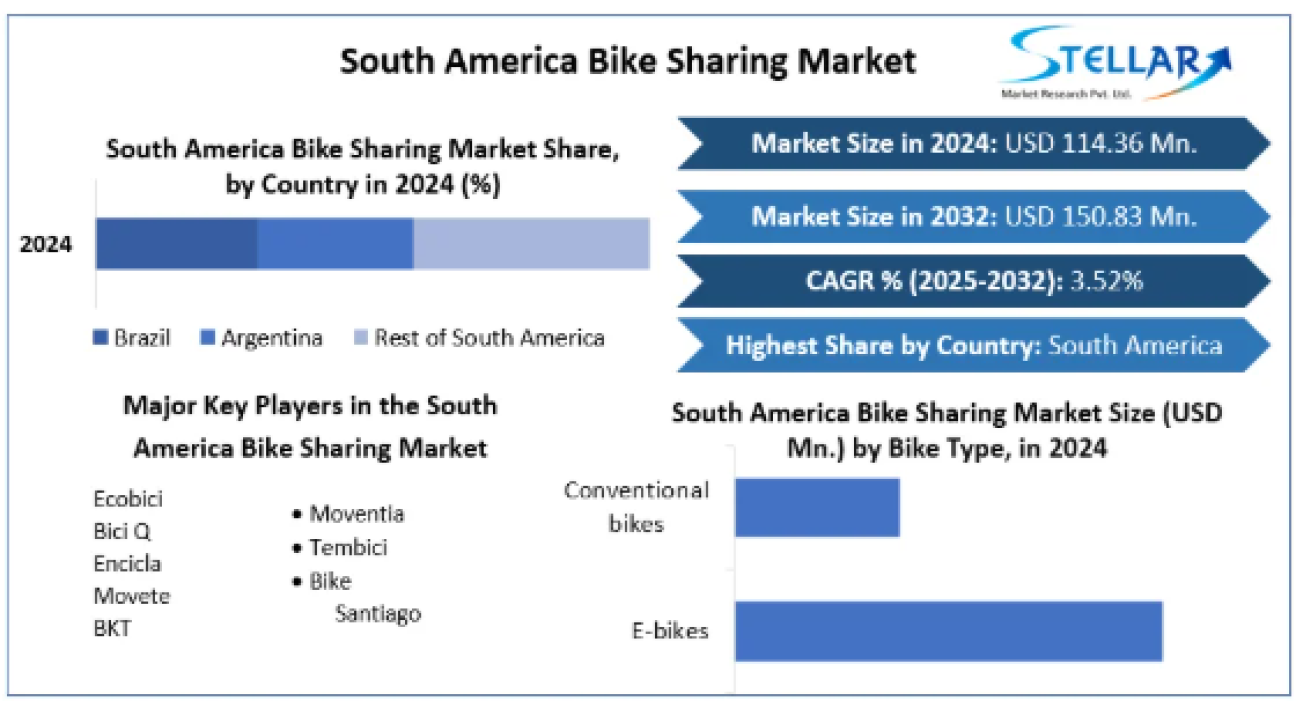

South America’s bike sharing market is witnessing steady expansion as urban centers increasingly adopt sustainable and efficient mobility solutions to address congestion, environmental concerns, and last-mile connectivity challenges. According to the latest market analysis, the South America Bike Sharing Market was valued at USD 114.36 million in 2024 and is projected to reach USD 150.83 million by 2032, growing at a compound annual growth rate (CAGR) of 3.52% during the forecast period (2025–2032).

By the end of 2024, the region had 92 public bike sharing systems (BSS) operational across 11 Latin American countries, highlighting the increasing importance of cycling infrastructure in urban mobility planning. Brazil leads the regional landscape with 42 systems, followed by Colombia with 18 systems and Argentina with 15 systems. The majority of these systems are concentrated in cities with populations exceeding one million, although mid-sized cities with populations between 250,000 and 500,000 inhabitants are also emerging as important adopters.

Request your sample copy of this report now! https://www.stellarmr.com/report/req_sample/South-America-Bike-Sharing-Market/70

Market Evolution and Growth Dynamics

Bike sharing in South America has evolved significantly since Rio de Janeiro launched the region’s first system, SAMBA, in 2008, which initially comprised 19 stations and 190 bicycles. Over the following decade, bike sharing gained traction, supported by technological advancements, urbanization, and a growing emphasis on low-carbon transport. A major surge occurred between 2017 and 2020, when 25 dockless systems and 28 new dock-based systems were introduced.

By December 2020, all 92 systems analyzed were fully operational, although not all systems followed a linear growth path. Over time, several programs underwent restructuring, technological upgrades, or operational changes to improve performance and user satisfaction. Notably, 19 systems experienced significant restructuring, reflecting the experimental and adaptive nature of bike sharing models in emerging urban markets.

Dock-Based Systems Dominate the Market

Currently, dock-based bike sharing systems account for approximately 72.83% of all systems operating in Latin America. These systems are widely deployed in both megacities such as São Paulo, Mexico City, and Buenos Aires, as well as smaller municipalities like Quimbaya, Colombia, which has a population of fewer than 30,000 residents. Dock-based systems are often preferred by city authorities due to their structured infrastructure, reduced risk of theft and vandalism, and easier fleet management.

Prominent dock-based programs across the region include Bikesantiago and Bici Las Condes in Santiago, Ecobici in Buenos Aires and Mexico City, Encicla in Medellín, Movete in Montevideo, and Bici Q in Quito. These systems benefit from dedicated docking stations that ensure bicycles are parked in designated areas, reducing urban clutter and improving system reliability.

One of the largest players in the station-based segment is Tembici, which operates the largest dock-supported bike sharing network in Latin America. Developed in partnership with Itaú Unibanco, Tembici initially launched in Brazil and expanded to 18 cities by early 2019. Leveraging advanced artificial intelligence platforms such as BICO, Tembici and its technology partners are now planning further expansion into cities like Santiago and Buenos Aires.

Integration with Public Transit and Last-Mile Solutions

Bike sharing systems in South America are increasingly positioned as critical components of integrated urban transport networks. By addressing the “last-mile” problem, BSS allows commuters to travel efficiently between transit hubs and final destinations. Systems are often installed near metro stations, bus terminals, and transit corridors to encourage seamless multimodal travel.

However, the effectiveness of integration varies across the region. Lack of coordination between transport agencies, institutional governance challenges, and limited transportation subsidies—particularly affecting low-income populations—remain key barriers to broader adoption. Despite these challenges, many governments are actively supporting bike sharing initiatives as part of broader sustainability and urban mobility strategies.

Operational Models and User Accessibility

Operationally, most bike sharing systems in Latin America function seven days a week, typically between 5:00 a.m. and midnight. Approximately 18 systems operate 24 hours a day, while some adjust operating hours on weekends. Across the region, there are 48 different operators, with private enterprises dominating system operations.

User accessibility is supported through a range of pricing models. Twenty-nine systems offer free usage, while others provide flexible daily, monthly, or annual subscription plans. Payments are commonly accepted via credit and debit cards, improving convenience for users. To ensure compliance and proper usage, at least 70 systems impose penalties or additional charges for violations such as exceeding ride limits or improper parking.

A significant proportion of bike sharing programs receive government backing, reflecting public sector efforts to promote cycling, reduce emissions, and improve urban mobility. Additionally, several systems benefit from sponsorship by financial institutions and healthcare companies, which view bike sharing as an opportunity to promote wellness and corporate social responsibility.

To delve deeper into this research, kindly explore the following link: https://www.stellarmr.com/report/South-America-Bike-Sharing-Market/70

Dockless Bike Sharing: A High-Growth Opportunity

While dock-based systems currently dominate, dockless bike sharing is expected to experience rapid growth during the forecast period. Dockless models offer greater flexibility, allowing users to park bicycles near their destination without the need for fixed stations. This convenience makes dockless systems particularly attractive in dense commercial districts and high-traffic urban areas.

One of the most prominent dockless players in the region is Yellow, a Brazilian bike and scooter sharing company. In partnership with Mexican electric scooter startup Grin, Yellow formed Grow Mobility, a major last-mile mobility group operating across six Latin American countries. Between October 2018 and January 2019, the company raised USD 259 million in secured funding, underscoring strong investor confidence in dockless mobility solutions.

However, dockless systems face challenges related to bicycle availability, vandalism, and theft—particularly in less secure neighborhoods. To mitigate these risks, operators are investing in advanced GPS tracking technologies, proprietary bicycle components, and data-driven fleet management systems.

Market Segmentation and Competitive Landscape

The South America Bike Sharing Market is segmented by bike type, business model, sharing system, and country. By bike type, the market includes conventional bicycles and e-bikes, with electric bikes gaining popularity due to their ability to handle longer distances and hilly terrain. By model, systems are categorized into station-based, free-floating, and peer-to-peer (P2P) models, while sharing systems include docked, dockless, and hybrid configurations.

Key players operating in the market include Ecobici, Bici Q, Encicla, Movete, BKT, Moventia, Tembici, and Bike Santiago, among others. Competition is characterized by strategic partnerships, technology integration, and geographic expansion.

Outlook

With growing urban populations, increasing environmental awareness, and continued government support, the South America Bike Sharing Market is poised for sustainable growth. While challenges related to governance, infrastructure coordination, and equity remain, ongoing innovation in technology and operations is expected to enhance system efficiency and user adoption. As cities continue to prioritize active and shared mobility, bike sharing will play an increasingly vital role in shaping the future of urban transportation across South America.

Find the Latest Buzz :

Mountain Bike Apparel Market https://www.stellarmr.com/report/Mountain-Bike-Apparel-Market/1687

Motorcycle Apparel Market https://www.stellarmr.com/report/Motorcycle-Apparel-Market/1834

About Stellar Market Research:

Stellar Market Research is a global leader in market research and consulting services, specializing in a wide range of industries, including healthcare, technology, automobiles, electronics, and more. With a team of experts, Stellar Market Research provides data-driven market insights, strategic analysis, and competition evaluation to help businesses make informed decisions and achieve success in their respective industries.

For more information, please contact:

Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness