South Korea Cloud Computing Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Cloud Computing Market Report by Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), Workload (Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, and Others), Deployment Mode (Public, Private, Hybrid), Organization Size (Large Enterprise, Small and Medium Enterprise), Vertical (BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Cloud Computing Market Overview

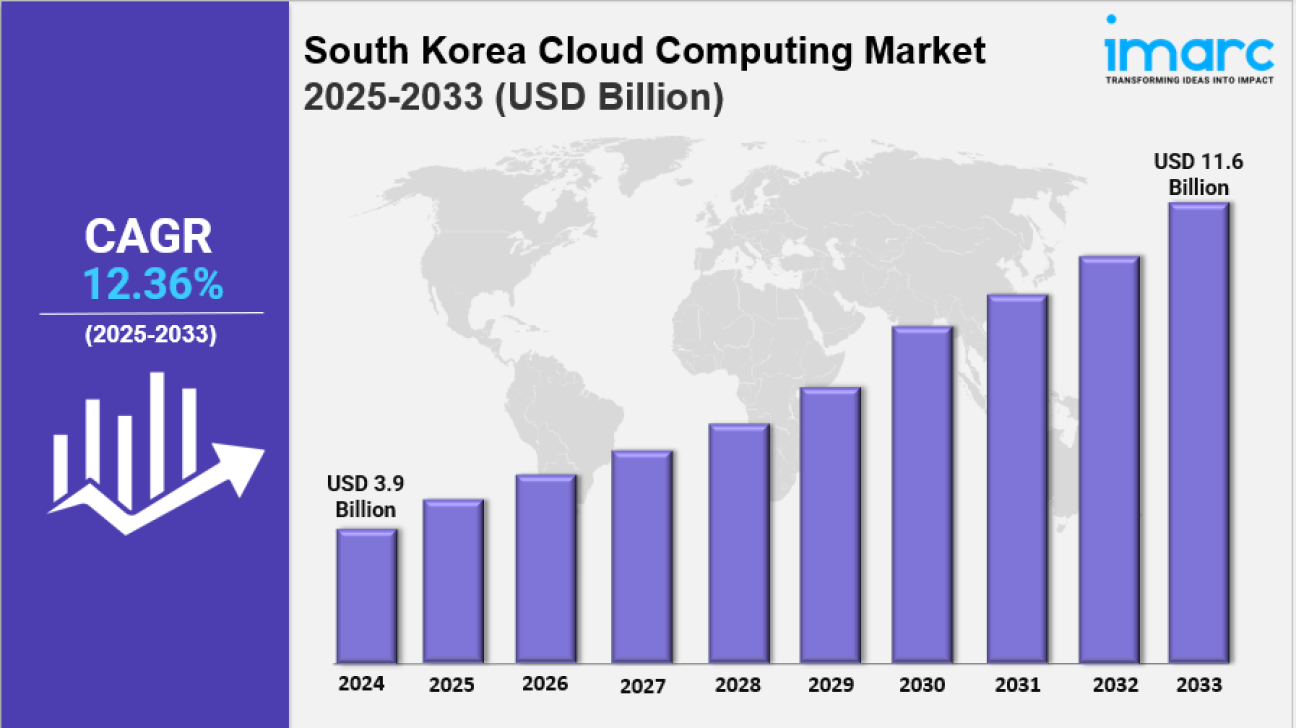

The South Korea cloud computing market size was valued at USD 3.9 Billion in 2024 and is projected to reach USD 11.6 Billion by 2033, growing at a CAGR of 12.36% during the forecast period of 2025-2033. This growth is driven by rising cybersecurity threats, increased digital education initiatives, and widespread adoption in healthcare.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

South Korea Cloud Computing Market Key Takeaways

- Current Market Size: USD 3.9 Billion in 2024

- CAGR: 12.36% during 2025-2033

- Forecast Period: 2025-2033

- Rising incidences of cybersecurity threats and data breaches are primary growth drivers.

- Increasing adoption of multi-cloud strategies helps avoid vendor lock-in and optimize providers' capabilities.

- Integration of AI and ML enhances cloud computing data analytics and decision-making.

- West region dominates due to established IT infrastructure and tech-savvy workforce.

- Government initiatives and strategic private-sector collaborations promote cloud technology adoption.

Sample Request Link: https://www.imarcgroup.com/south-korea-cloud-computing-market/requestsample

Market Growth Factors

The South Korea cloud computing market is primarily driven by the rising incidences of cybersecurity threats and data breaches. Organizations are increasingly adopting cloud solutions to enhance data security through encryption, access controls, and regular security updates. These measures mitigate vulnerabilities and provide centralized data storage and backup services, which enhance disaster recovery capabilities. For instance, a significant data breach by North Korean hackers in 2024, involving theft of 1,014 gigabytes from a court's system, has heightened demand for cloud security solutions.

Another growth factor is the government's strong support and investment in the cloud computing sector. In May 2024, the South Korean Ministry of Science and ICT announced a US$ 91.5 Million investment plan, which includes funding for commercializing advanced cloud services (US$ 18.1 Million) and transforming traditional software into SaaS models (US$ 6.0 Million). Strategic partnerships with private enterprises further accelerate cloud adoption across industries such as healthcare and finance.

Technological advancements and rapid digitalization also boost the market. The rise of remote work saw the number of remote employee’s surge from 66 thousand in 2015 to 1.1 million by 2021—a 17-fold increase mostly during 2020-2021. Moreover, South Korea ranks 5th in the Global Innovation Index (2021) and holds the sixth-largest private AI investment globally (2022). These factors, coupled with the adoption of big data, AI, and machine learning technologies, increase demand for cloud services that offer quick deployment, scalability, and robust computing power.

Market Segmentation

Breakup by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS): Holds the largest market share as it eliminates upfront software costs and maintenance, provides quick deployment without extensive IT infrastructure, offers scalability, and operates on a subscription basis with integrated analytics features.

Breakup by Workload:

- Application Development and Testing

- Analytics and Reporting

- Data Storage and Backup

- Integration and Orchestration

- Resource Management: Dominates the market by streamlining deployment, reducing management complexity, enabling optimal utilization of computing resources for cost savings, and aiding in regulatory compliance.

- Others

Breakup by Deployment Mode:

- Public: Largest segment, offering easily accessible cloud services over the internet at lower cost with pay-as-you-use models that promote widespread adoption.

- Private

- Hybrid

Breakup by Organization Size:

- Large Enterprise: Largest market shares due to complex operations requiring robust computing, storage, and networking, and multi-region operations needing seamless collaboration.

- Small and Medium Enterprise

Breakup by Vertical:

- BFSI: Largest segment, using cloud for data analytics, risk management, fraud detection, and CRM, enabling agility and scalability.

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

Regional Insights

The West region of South Korea dominates the cloud computing market due to its well-established IT infrastructure, including high-speed internet and advanced data centers. Key corporations and financial institutions headquartered in cities like Seoul and Incheon further bolster this dominance. Additionally, the West benefits from a highly skilled, tech-savvy workforce and an innovation hub environment with leading educational and research institutions driving R&D in cloud technology.

Recent Developments & News

- April 2024: Gcore, a Korean AI firm, launched its first AI public cloud service in Korea powered by NVIDIA’s H100 GPUs, with a data center housing 40 NVIDIA H100 servers.

- January 2024: Korea Quantum Computing (KQC) partnered with IBM to utilize IBM’s AI software, infrastructure, and quantum computing services including Watsonx, aiding advanced AI model training and deployment.

- January 2024: Samsung Electronics and Google Cloud announced a multi-year partnership to bring Google Cloud’s generative AI technology to Samsung smartphone users.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness